Note: I’m changing the Monthly Analysis of the Grains sector this month, looking at the long-term investment side with ETFs for the three major markets as well as continuous December corn and November soybeans monthly charts. I’ll discuss the National Cash Indexes for the five major markets (corn, soybeans, three wheats) in Monthly Supply and Demand Commentary based on the idea these Indexes are the key read on real fundamentals.

Teucrium Corn Fund (CORN) remains in a major (long-term) uptrend. Theoretical Positions: CORN could’ve been bought near the August settlement of $17.70. Additional longs could be established on buy stops above the previous 4-month high of $18.85 during January. Sell stops would be moved to below the previous 4-month low of $17.45 (October 2024), or left below the major low of $17.02 from August 2024.

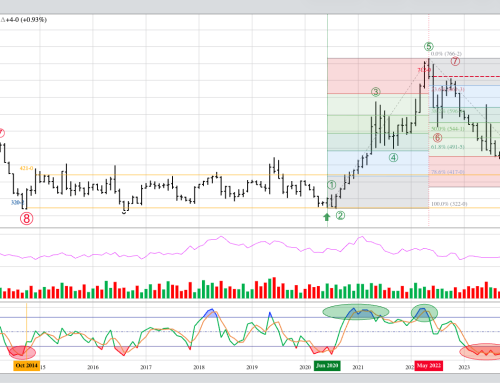

December Corn: The market remains in a major uptrend. Dec25 extended the trend to a high of $4.4425 during December before closing at $4.4375, up 20.75 cents for the month.

Theoretical Positions:

- Hedgers:

- See Weekly Analysis: Grains (both Futures and Cash)

- Traders:

- Short Dec24 futures positions could’ve been covered near the August close of $4.01.

- And long positions established at the same price

- These long positions could’ve been rolled to Dec25 at a carry of 25.5 cents on Monday, October 28

- Dec24 was at (roughly) $4.1325

- Dec25 was at (roughly) $4.3875 (new long position)

- Dec25 closed December at $4.4375

- Short Dec24 futures positions could’ve been covered near the August close of $4.01.

The Teucrium Soybean Fund (SOYB) completed a bullish spike reversal during December, moving to a major uptrend as it settled at $21.48, up $0.28 for the month. Theoretical Positions: Investors could buy near the December settlement of $21.48 with sell stops below the December low of $20.20.

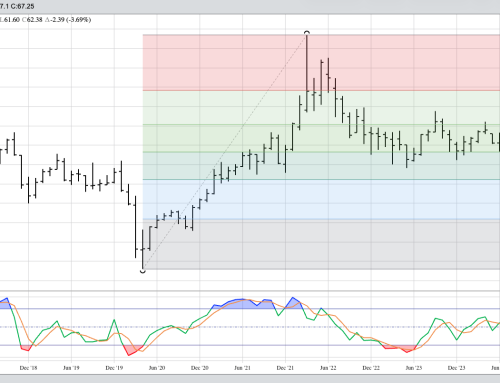

November Soybeans: The continuous monthly chart for November soybeans continues to show a major sideways trend. Support is at the August 2024 low of $9.55 with resistance the high of $10.6975 from September. Theoretical Positions: Traders would’ve gotten out of short November 2024 futures positions before the contract moved into delivery at the end of October. New Nov25 positions are on hold for now, though sell stops could be below the August low of $9.55 with buy stops above the September high of $10.6975. The Nov25 contract closed December at $10.2525.

The Teucrium Wheat Fund (WEAT): I’m not sure what to make of WEAT at this time. However, if I apply the idea of wheat’s characteristic Head Fake Phenomenon (Wheat markets/contracts have a tendency to take out support or resistance, then go back in the direction they were previously headed) and the Krampus Countdown (Don’t be long wheat in December), I could still make the argument the major trend is still up. Additionally, WEAT completed another bullish spike reversal at the end of December. Theoretical Positions: Investors might’ve gone long WEAT near the August settlement of $4.97. If not, based on the above mentioned Krampus Countdown, long-term long positions could be established near the December settlement of $4.82 with a sell stop below the December low of $4.65.