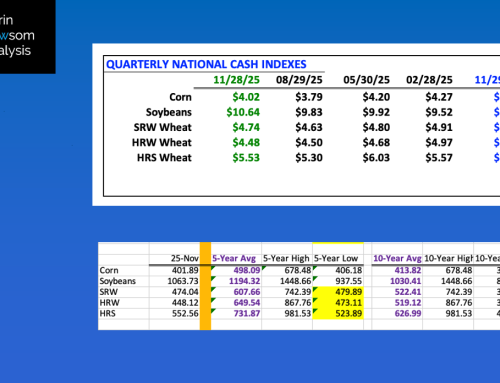

The bottom-line supply and demand number is stocks-to-use (s/u). I’ve long said stocks-to-use are the Readers’ Digest version of supply and demand, in that one number can tell us the bullishness, bearishness, or neutrality of a market’s fundamentals. I’ve also argued endlessly over the years with economists, my point being there should be a direct correlation between stocks-to-use and cash price. Given this premise, I’ve developed my system between the two for all three major markets (wheat, corn, and soybeans) with the r-squared[I]for all three near 100%. In all cases I’m using the cmdty National Cash Price Indexes (weighted national average cash prices from Barchart), and in wheat that means HRW, SRW, and HRS have been weighted to reflect US production of all wheat supplies. The Darin Newsom Analysis, Inc. (DNAI) stocks-to-use numbers are calculated at the end of every month, and then compared to the previous month and the previous year. The DNAI numbers may not agree with subsequent USDA report estimates, but that is understandable given the DNAI numbers are real (based on national average cash prices) rather than imaginary (based on…I have no idea).

WHEAT: The 2021-2022 combined daily average cash price for the three major wheat markets was $7.27 at the end of November, correlating to a s/u figure of 24.6%. The end of October showed s/u of 25.5% and the previous November 44.7%. The key here is US wheat supply and demand continues to tighten. That having been said, and as I discussed in Monthly Analysis, the long-term trends of both HRW and HRS wheat markets could be in the process of turning down. Fundamentally, both markets remain bullish, as indicated by inverted futures spreads.

CORN: The 2021-2022 daily average of the NCPI though the end of November was calculated at $5.28, solidly higher than the October average of $5.14. This trimmed my s/u calculation to 9.6% from last month’s 9.8%, and still well below last November’s calculation of 12.1%. Taking a look at the attached chart could cause concern among end-users as US corn available stocks-to-use at the end of 2021-2022 Q1 are roughly equal what was calculated at the end of 2020-2021 Q4. This means the 2021 harvest did nothing to add to available stocks in relation to demand. As we head into 2021-2022 Q2, end-users and exporters could find it difficult to source cash supplies to meet demand, a situation that should continue to support the basis market.

SOYBEANS: The 2021-2022 daily average of the NSPI though the end of November was calculated at $12.10, down from the Octoer average of $12.12. However, this kept my s/u calculation to 0.4%, unchanged from October but still well below last November’s 2.0%. The November figure is also up fractionally from the end of the 2020-2021 marketing year this past August, when the NSPI average price of $12.83 correlated to s/u of 0.2%. This tells us available stocks did increase over the course of the 2021 harvest, not a surprise since cash bushels were being sold so corn bushels could be stored over the winter.

[i] R-squared is defined as “a statistical measure of fit that indicates how much variation of a dependent variable is explained by the independent variable in a regression model.” (Investopedia). In my world, it is how closely related two (or more) variables are, in this case national average cash price and stocks-to-use.