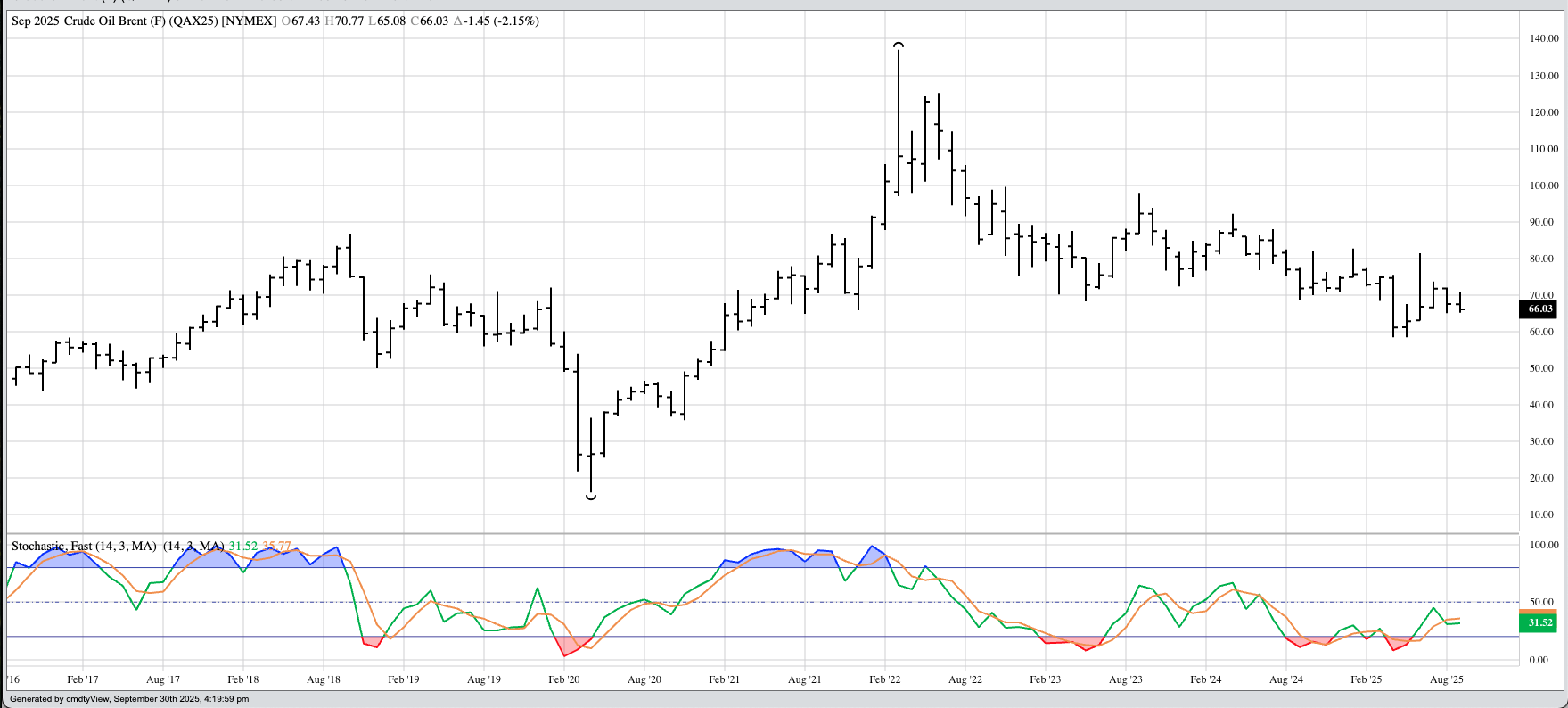

Brent crude (QA): I don’t see a clear pattern on the market’s long-term monthly chart. Theoretical Positions: Long-term investors are likely on the sidelines for now given the forward curve remains in backwardation. If long positions were established in June when the spot-month contract posted a new 4-month high beyond $77.53, sell stops would be below the previous 4-month low of $62.97 (June 2025).

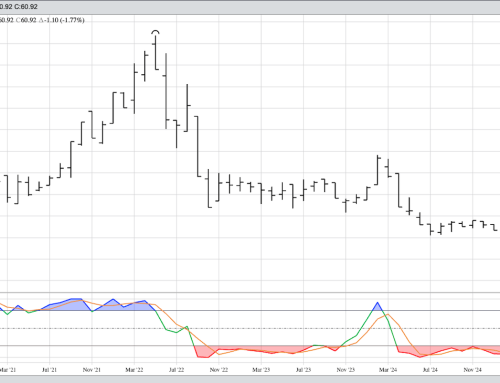

WTI crude oil (CL): I don’t see a clear pattern on the market’s long-term monthly chart. Theoretical Positions: Long-term investors are likely on the sidelines for now given the WTI forward curve remains in backwardation. If long positions were established in June when the spot-month contract posted a new 4-month high beyond $75.18, sell stops would be below the previous 4-month low of $61.06 (June 2025).

Distillates (HO, heating oil, diesel fuel, jet fuel, etc.): The market continued to consolidate during September. Theoretical Positions: Investors could be on the sidelines. However, if long positions were established in June when the spot-month contract posted a new 4-month high beyond $2.5213, sell stops would be below the previous 4-month low of $2.0038 (June 2025). The market’s forward curve remains in backwardation indicating a bullish supply and demand situation.

RBOB gasoline (RB): The market remains in a major sideways trend. Theoretical Positions: Investors would be on the sidelines.

Natural gas (NG) was giving no clear technical signs at the end of September. Theoretical Positions: Traders are likely on the sidelines at this time.