This analysis is making an assumption the Cash Indexes reflect the actual cash markets.

Live Cattle (Cash Index): The Index rebounded during December, closing at $229, up $14 for the month. While it could still be argued the Index is technically bearish, the downtrend during October and November looks to have been manipulated and politically motivated. Fundamentally, futures spreads remain bullish through the summer 2026 contracts. Theoretical Positions: Long-term investors may have moved to the sidelines in cattle given it is a market in the crosshairs of the US president. If short positions were established near the September settlement of $240, based on what looked to be uncertainty at the time, then sell stops would be above the September high of $242.

Feeder Cattle (Cash Index): Despite the higher monthly close for December, the Index could still be considered in a major downtrend given the completion of a bearish key reversal during November. If so, the December rally would be considered part of a Wave B (second wave) within a 3-wave downtrend pattern (Elliott Wave). Fundamentally the market remains bullish, meaning we could be seeing a classic Rubber Band Disposition develop, a situation that tends to resolve itself with technical analysis getting back in line with fundamental analysis. Theoretical Positions: Long-term investors likely sold the market near the October settlement of $343.33 based on the completed bearish key reversal. The Index closed December at $348.44, up $28.754.

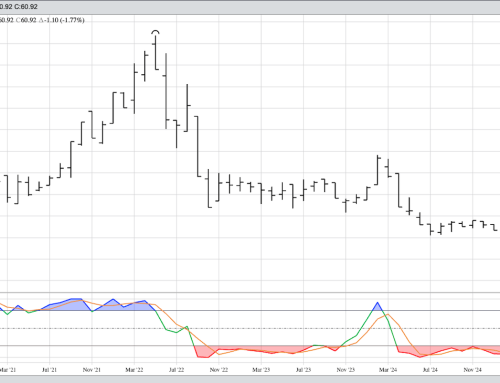

Lean Hogs (Cash Index): The Index held eerily steady during December before closing at $82.25, up $0.58 for the month. Despite this, the major trend could still be considered down until giving some indication of a bullish change. The lean hog market was fundamentally neutral at the end of December. Note monthly stochastics have dipped below the oversold level of 20%. Theoretical Positions: Long-term investors may have shorted hogs near the new 4-month low of $96.30 during October, but are most likely on the sidelines at this time.