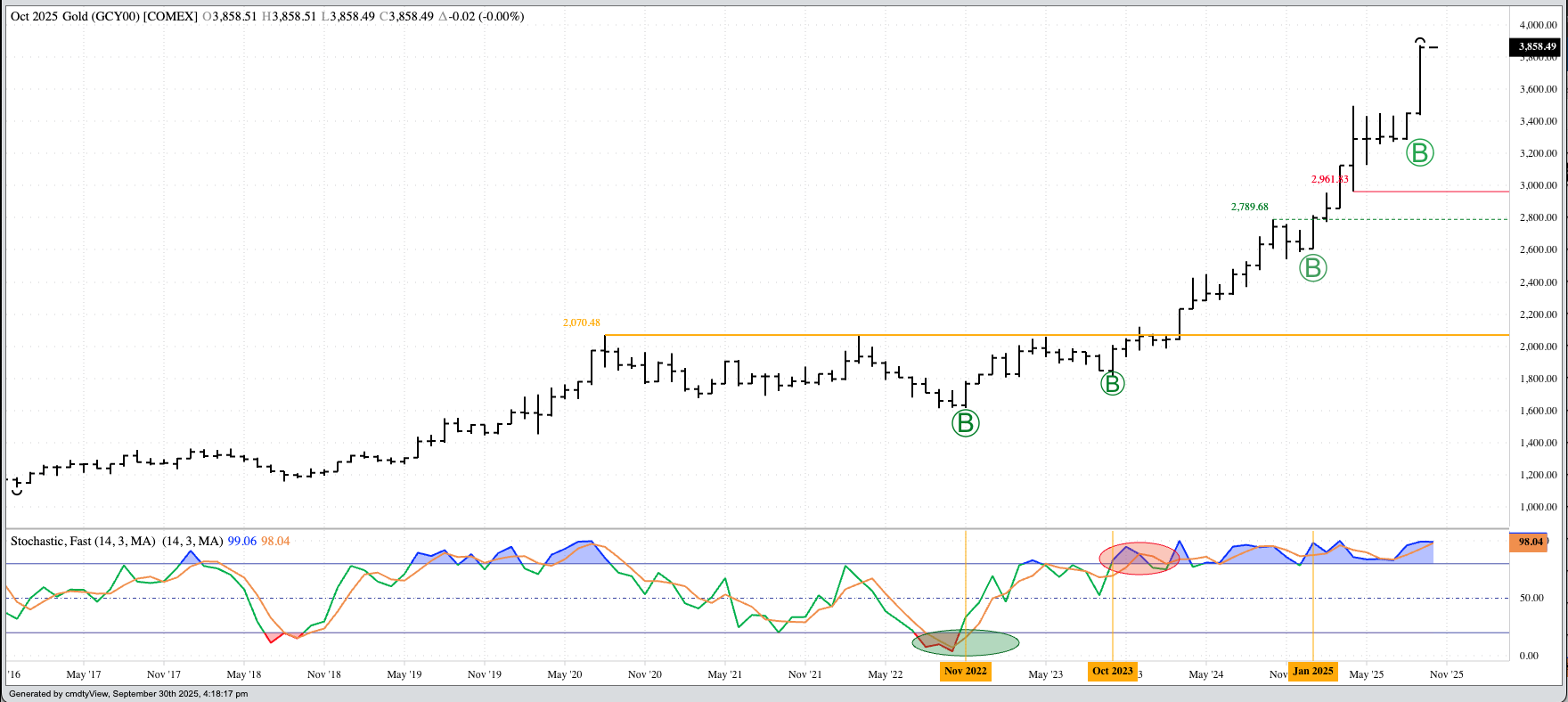

Gold (Cash Index): The cash index (GCY00) closed September at $3,858.51, a new record high monthly close. Through the early morning hours of October 1, the Index has extended its major (long-term) uptrend to a high of $3,895.23, due in part to the US government shutdown. Theoretical Positions: It’s possible investment traders bought near the October 2023 close of $1,983.91 as previous short positions were stopped out. There have been numerous buys, mostly on new 4-month highs, since the key bullish reversal completed during November 2022. For those arguing gold has reached a technical top: The market is not a technical trade at this point but rather a fundamental safe-haven market against increased global uncertainty, including a US government shutdown.

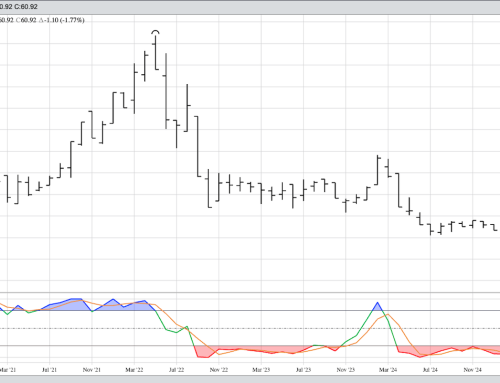

Silver (Cash Index): The cash index (SIY00) extended its major uptrend to a high of $47.1715 during September before closing at $48.6464. Through the early morning hours of October 1, the Index has extended its major (long-term) uptrend to a high of $47.5460. Theoretical Positions: Traders might’ve gone long as a new 4-month high ($25.7691) was posted during April 2024. If so, sell stops might’ve been triggered below the previous 4-month low of $28.7926 during April 2025, resulting in a gain of $3.02353 (11.7%). New buy orders might’ve been triggered above the previous 4-month high of $34.5382 during June.

Copper (Cash Index): The copper index closed September at $4.8130, up $0.3025 (6.7%) for the month. Theoretical Positions: It’s possible investors moved to the sidelines in late July, liquidating long positions and adding to the pressure in the market to close out the month. Technically, I do not have a good read on copper at this time, though the big picture continues to look like a major uptrend.