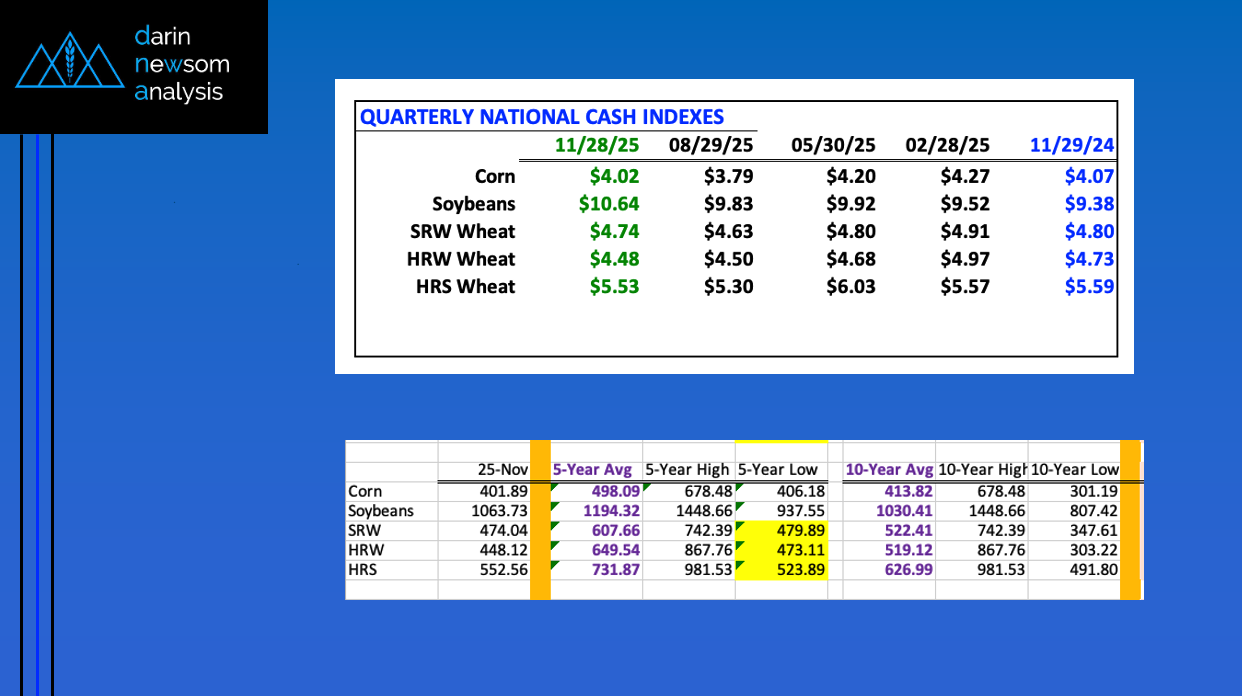

The Law of Supply and Demand: Market Price is the point where the quantity demanded equals quantities available creating a market equilibrium. If we consider the three variables in the equation (Market Price = Supply, Demand) the only one known is Market Price. Therefore, a study of Market Price is all that is needed to understand the relationship between the unknown variables of Supply and Demand. For Market Price I’m using National Cash Indexes for the 5 major grain markets.

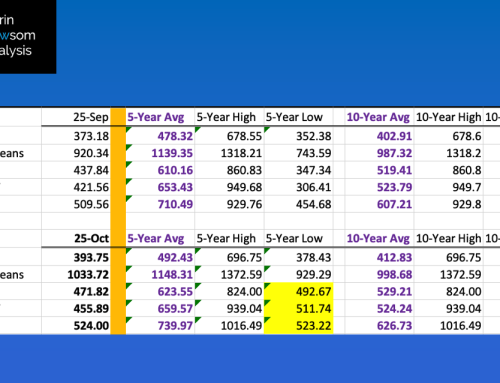

CORN: The National Corn Index was priced at $4.0189 at the end of November, as compared to end of October figure of $3.9075 and last November’s $3.8226. The previous 5-year end of November average price was $4.9809 with the 5-year end of November low at $4.0618. The 10-year end of November average price was at $4.1382. As for Quarterly numbers, the November 2025 price was up from the end of August $3.79, despite the large US harvest, telling us demand stayed strong during Q1. Export demand through the first 8 weeks of the quarter was running well ahead of last year’s pace. The quarterly price at the end of November 2024 was $4.07, again indicating more total bushels of supply for the 2025-2026 marketing year. Given this, the market will need to see continued strong demand during the winter quarter or a contra-seasonal selloff by the Index is possible.

SOYBEANS: The National Soybean Index was priced at $10.6373 at the end of November, as compared to end of October figure of $10.3372 and last November’s $9.3755. The previous 5-year end of November average price was $11.9432 with the 5-year end of November low at $9.3755 (2024). The 10-year end of November average price was $10.3041. As for Quarterly numbers, the November 2025 price was up from the end of August $9.83, and as previously noted, the end of November 2024 figure of $9.38. Demand for US soybeans saw its seasonal upturn during the fall quarter (Q1). However, through the first 8 weeks of the 2025-2026 marketing year, export demand was running well behind last year’s pace. This tells us a couple things: First, supplies are shorter this year than last and second, there has been a lot more noncommercial activity in the futures market. Setting that aside, deferred futures spreads covered less calculated full commercial than a year ago indicating Brazil’s next crop may not be large enough to meet demand.

SRW WHEAT: The National SRW Wheat Index was priced at $4.7404 at the end of November, as compared to end of October figure of $4.7182 and last November’s $4.7989. The previous 5-year end of November low price was $4.7999 with the 2025 settlement the lowest end of November price since 2017’s $3.8933. This indicates US supply and demand was the more bearish than any other end of November during that time frame. As for Quarterly numbers, the November 2025 price was up from the end of August $4.63 but slightly lower than the November 2024 figure near $4.80. Fundamentally, there isn’t much to get excited about with SRW wheat halfway through the 2025-2026 marketing year.

HRW WHEAT: The National HRW Wheat Index was priced at $4.4812 at the end of November, as compared to end of October figure of $4.5589 and last November’s $4.7311. The previous 5-year end of November low price was $4.7311 (2024) with the 2025 settlement the lowest end of November price since 2019’s $4.1447. As for Quarterly numbers, the November 2025 price was down slightly from the end of August $4.50 and well below the November 2024 figure near $4.73. The bottom line is the US HRW wheat market is more fundamentally bearish than last year heading into the winter quarter.

HRS WHEAT: The National HRS Wheat Index was priced at $5.5256 at the end of November, as compared to end of October figure of $5.24 and last November’s $5.5870. The previous 5-year end of November low price was $5.2389 This indicates US supply and demand was nearly as bearish as it has been the past five years as the fall quarter (Q2) came to an end. As for Quarterly numbers, the November 2025 price was up from the end of August $5.30 but slightly lower than the November 2024 figure near $5.59. The bottom line is the US doesn’t look to run of HRS supplies during the second half of the 2025-2026 marketing year.