Brent crude (QA) rejoined its major (long-term) downtrend as it moved to a new 4-month low of $68.20 during May. Monthly stochastics remain below the oversold level of 20%, leaving the market in position for a potential bullish reversal over the coming months. Theoretical Positions: Short from the June close of $114.81 possibly. If not, shorts could’ve been established at the July close of $103.97 after the spot-month contract posted a new 4-month low below $96.95. Stops would be above the previous 4-month high of $87.49 with new longs established at the same time.

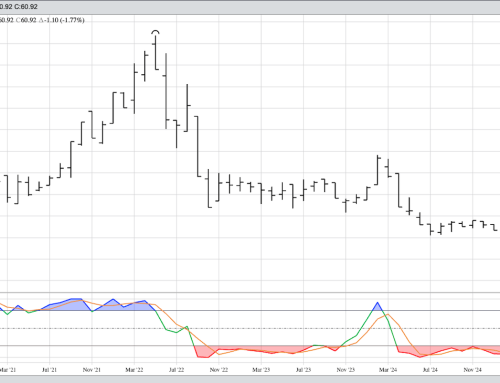

WTI crude oil (CL) rejoined its major downtrend as the new 4-month low during May offset the 4-month high posted during April. Theoretical Positions: Long positions established near the new 4-month high of $83.34 during April would’ve been stopped out with the new 4-month low of $64.11 during May (loss of $19.23). There are no positions at this time.

Distillates (HO, heating oil, diesel fuel, jet fuel, etc.) extended its major 3-wave downtrend to a low of $2.15 during May. Monthly stochastics established a bullish crossover below the oversold level of 20%, a signal the major trend should soon turn up.

RBOB gasoline (RB) remains in a major 5-wave uptrend. The spot-month contract continues to post a contra-seasonal selloff that would be viewed as Wave 2 of the 5-wave pattern. Theoretical Positions: New longs could’ve been established near the December 2022 close of $2.4783, with sell stops below the December low of $2.0204.

Natural gas (NG) looks to be in a major sideways trend. Theoretical Positions: With monthly stochastics well below the oversold level of 20%, the logical move is to see a bullish breakout. But we are talking about natural gas. Still, buy stops could break placed above the previous 4-month high of $3.027. If filled, sell stops would be placed below the 4-month low of $1.946.