The S&P 500 ($INX) remains in a major (long-term) 5-wave uptrend with initial resistance at the February high of 4,195.44. Theoretical Positions: Long from the October close of 3,871.98 with a stop below the October low of 3,491.58.

The Dow Jones Industrial Average ($DOWI) also remains in a major 5-wave uptrend, though the Wave 1 high still looks to be the December mark of 34,712.28. March saw the $DOWI post a bullish spike reversal indicating a Wave 2 selloff has been completed. Theoretical Positions: Long from at least the October settlement of 32,732.95 if not the breakout of the September high at 32,504.04.

The Nasdaq ($NASX) remains in a major 5-wave uptrend with initial resistance at the February high of 12,269.55. Theoretical Positions: Long from the October close of 10,988.15 with a stop below the October low of 10,092.94.

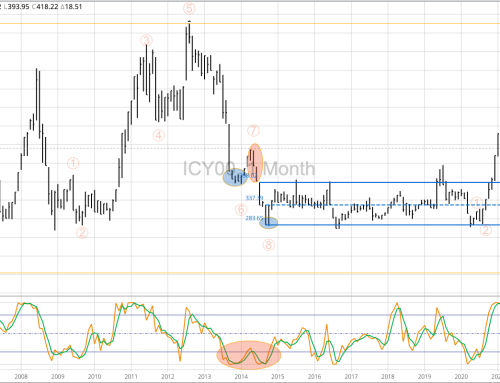

The US 10-year T-note (ZN) remains in a major 5-wave uptrend, completing a bullish outside range during March. This indicates Wave 2 of the major pattern was completed, with Wave 3 confirmed by the moved beyond the Wave 1 high of 116-080 (January 2023). Theoretical Positions: It’s possible longs might’ve been established at the November close of 113-070 based on monthly stochastics and a possible 2-month reversal. If so, stops would be placed below the October low of 108.265. Additional longs could’ve been established when the ZN took out the Wave 1 high of 116-080. If so, the average long would be roughly 114.575.