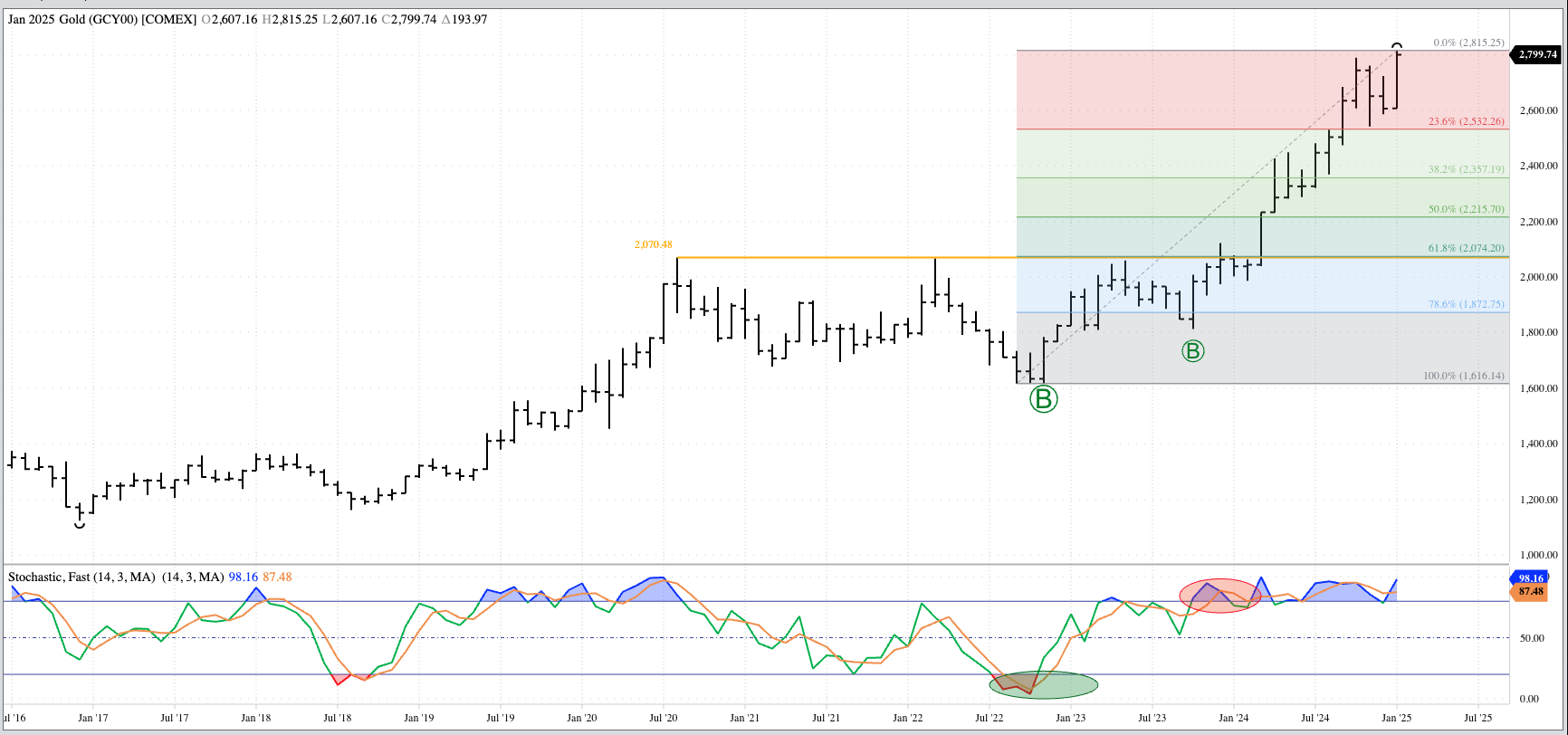

Gold (Cash Index): The cash index (GCY00) extended its major (long-term) uptrend to a new all-time high of $2,815.25 before closing January at $2,799.74, up $193.97 for the month. Given the Chaos has just begun, look for investors to continue to buy gold as a safe-haven market. Theoretical Positions: It’s possible investment traders bought near the October 2023 close of $1,983.91 as previous short positions were stopped out. Sell stops would be placed below the previous 4-month low of $2,541,42 (November 2024).

Silver (Cash Index): The cash index (SIY00) remains in a major uptrend, closing January at $31.3219, up $2.3510 for the month. Theoretical Positions: Traders might’ve gone long as a new 4-month high ($25.7691) was posted during April 2024. If still holding longs, the previous 4-month low is down at $28.7926 (December 2024).

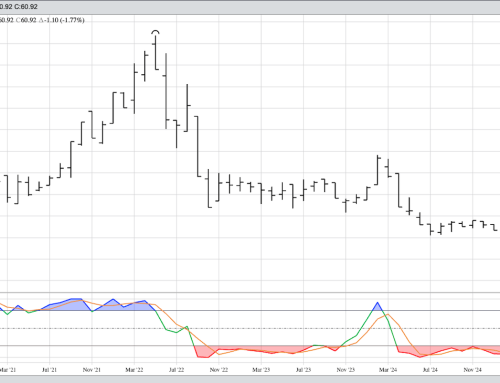

Copper (Cash Index): The index closed January at $4.2495, up 26.75 cents for the month. Theoretical Positions: It’s possible traders are staying on the sidelines for now. The previous 4-month high is $4.5930 (October 2024) with the previous 4-month low at $3.9820 (December 2024).