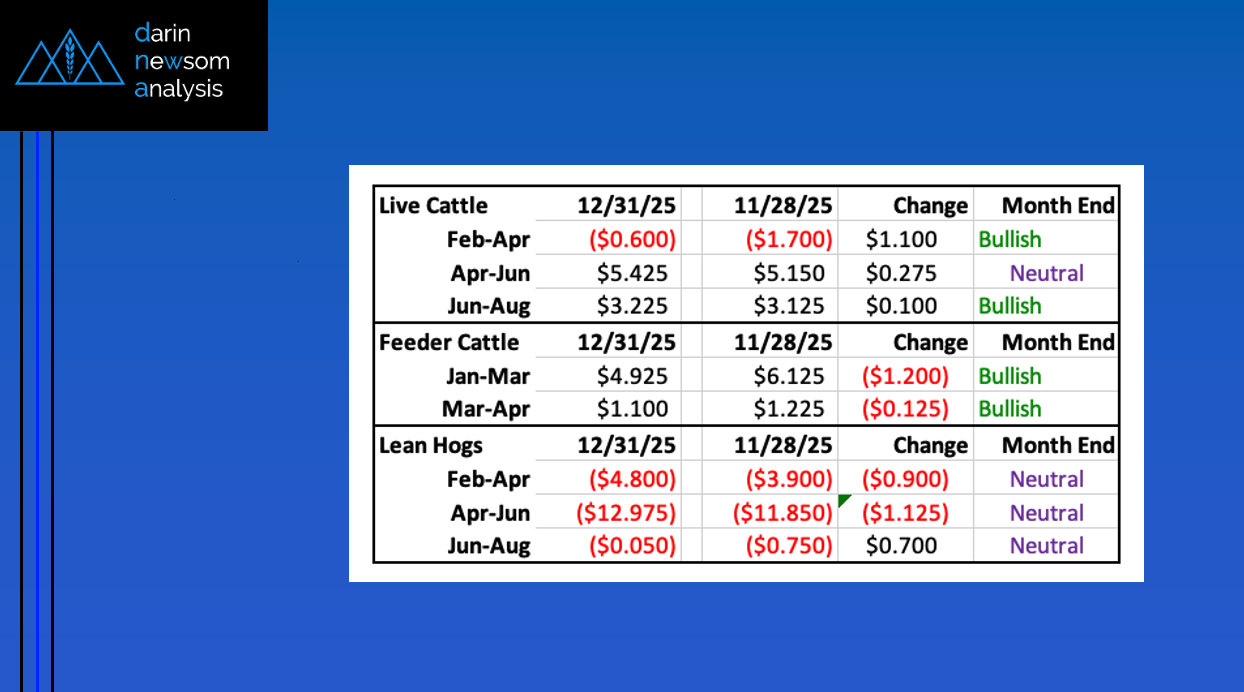

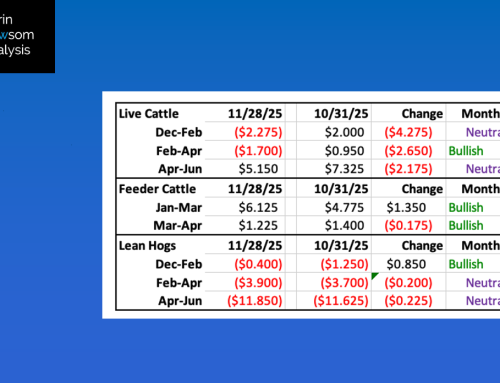

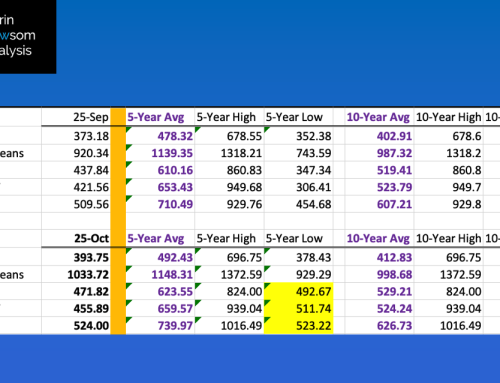

Live Cattle futures spreads: Neutral-to-Bullish

- The February-April closed December at (-$0.60)

- as compared to the end of November settlement at (-$1.70)

- and the previous 5-year high weekly close for the last week of December at (-$2.70)

- The April-June closed December at $5.425

- as compared to the end of November settlement at $5.15

- and the previous 5-year high weekly close for the last week of December at $8.00 (2022)

- with the previous 5-year median weekly close for the last week of December at $4.55 (2021)

- The June-August closed December at $3.225

- as compared to the end of November settlement at $3.125

- and the previous 5-year high weekly close for the last week of December at $1.825 (2025)

- Bottom Line: Futures spreads continue to indicate expected demand is outpacing real supplies through at least early summer 2026. This is contrary to what is being shown by USDA numbers, from daily boxed beef prices to monthly Cattle on Feed and Cold Storage reports. For now, the noncommercial side seems to be following the commercial view rather than the official government agency largely believed to be doing nothing more than the bidding of a US president looking to do to the US cattle industry what he did to US soybeans.

Feeder Cattle futures spreads: Bullish

- The January-March closed December at $4.925

- as compared to the end of November settlement at $6.125

- and the previous 5-year high weekly close for the last week of November at $0.825 (2025)

- The March-April closed November at $1.10

- as compared to the end of November settlement at $1.225

- and the previous 5-year high weekly close for the last week of December at (-$0.50) (2025)

- Bottom Line: As we make our way through the market’s quieter winter quarter (December through February), futures spreads continue to indicate tight supplies in relation to demand. That being said, there was some commercial pressure seen during December, as indicated by monthly changes in the two nearby futures spreads.

Lean Hogs futures spreads: Neutral

- The February-April closed December at (-$4.80)

- as compared to the end of November settlement at (-$3.90)

- and the previous 5-year median weekly close for the last week of December at (-$5.375) (2025)

- with the previous 5-year high weekly close for the last week of November at (-$4.15) (2021)

- The April-June closed December at (-$12.975)

- as compared to the end of November settlement at (-$11.85)

- and the previous 5-year median weekly close for the last week of December at (-$12.475) (2025)

- The June-August closed December at (-$0.05)

- as compared to the end of November settlement at (-$0.75)

- and the previous 5-year median weekly close for the last week of December at $0.40

- Bottom Line: Lean hogs saw some commercial selling in both the Feb-April and April-June futures spreads. However, there was some longer-term buying interest in the June-August spread. Despite the different activity, at the end of December futures spreads still indicated the commercial view was neutral.