I’ve changed my monthly discussion of real month-end fundamentals for the various grain markets. I’m simplifying the conversation by applying the Law of Supply and Demand: Market Price is the point where the quantity demanded equals quantities available creating a market equilibrium. My take on this Law is tweaked by looking at “available supplies” rather than “total supplies”, an important distinction in the Grains sector given supplies can be held off the market in on-farm or commercial storage. If we consider the three variables in the equation (Market Price = Supply, Demand) the only one known is Market Price. Therefore, a study of Market Price is all that is needed to understand the relationship between the unknown variables of Supply and Demand.

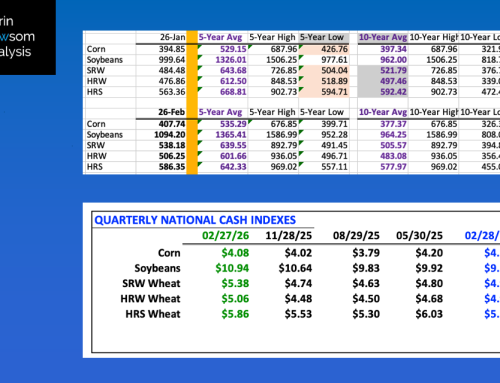

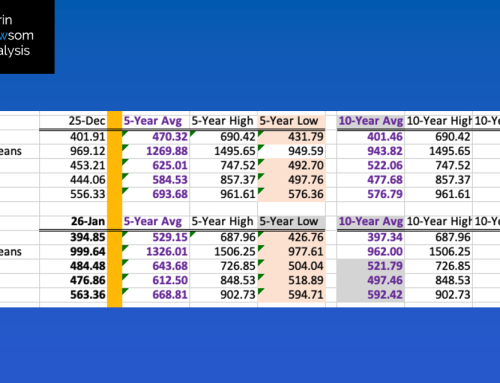

CORN: The National Corn Index (NCI) was calculated near $3.79 at the end of August putting available stocks-to-use (as/u) at 13.4%. The end of May saw as/u at 12.4% and August 2024 at 13.6%. As the 2024-25 marketing year came to an end corn supply and demand was little changed from the previous year with end of marketing year as/u still in the more cumbersome half of its 20-year range (slide 3). The 13.4% was near the previous 10-year end of August average at 13.1%. The bottom line is US corn fundamentals aren’t bearish, nor are they bullish, fitting with both basis and futures spreads heading into 2025-2026 marketing year. Based on the past 20 years, US corn as/u is expected to build during the next marketing year, completing a 10-year cycle (see Seasonal Analysis from August 28).

SOYBEANS: The National Soybean Index (NSI) was calculated near $9.83 at the end of August putting available stocks-to-use (as/u) at 15.9%. The end of May saw the NSI at $9.92 with as/u of 15.5% and August 2024 at $9.49 and 17.5%. With the 2024-2025 marketing year coming to an end, US soybean available stocks-to-use were down considerably from last year, due in large part to fewer acres planted in the spring of 2025. Additionally, the 15.9% was below the previous 10-year end of August average of 16.4%. Is the US supply and demand situation tight heading into the 2025-2026 marketing year? No (slide 4). but it is tighter than it was a year ago with fewer acres planted in 2025.

SRW WHEAT: The National SRW Wheat Index (SWI) was calculated near $4.63 at the end of August putting available stocks-to-use (as/u) at 47.0%. The end of May saw the SWI at $4.80 with as/u of 45.7% and August 2024 at $4.79 and 46.2%. The SRW supply and demand situation is growing more interesting as the end of August was the consecutive month with as/u tightening, though far from tight. We need to keep in mind since the last end of quarter (May 31) the US has gone through winter wheat harvest, increasing available supplies. The fact as/u didn’t increase much from the end of July at 46.6% indicates demand increased as well this past quarter. Still, the bottom line is the August 2025 figure of 47.0% was well above the previous 10-year end of August average of 44.3% meaning the US is far from running out of SRW supplies.

HRW WHEAT: The National HRW Wheat Index (HWI) was calculated near $4.50 at the end of August putting available stocks-to-use (as/u) at 46.8%. The end of May saw the HWI at $4.68 with as/u of 45.8% and August 2024 at $5.04 and 43.5%. The end of August 2025 was the largest end of month as/u figure since August 2020, also qt 46.8%. The previous 10-year end of August average is 44.4%. The bottom line is US HRW fundamentals remain bearish, something we can also see in the September-December futures spread finishing August covering 84% calculated full commercial carry. For the record, the July-September finished June at 83%.

HRS WHEAT: The National HRS Wheat Index (HSI) was calculated near $5.30 at the end of August putting available stocks-to-use (as/u) at 45.6%. The end of May saw the HSI at $6.03 with as/u of 41.7% and August 2024 at $5.35 and 45.4%. While down slightly from the end of July as/u figure of 45.8%, the end of August figure was well above the previous 10-year August average of 43.2% and the largest since 2020’s 47.5%.