The HRW Wheat Price Index (IHY00, national average cash price) moved back into a major (long-term) downtrend during July. The index took out its previous low of $5.0960 (March 2024) on its way to a mark of $4.9960. However, closing July at its monthly low sets the stage for a potential bullish reversal during August. Theoretical Positions: While 2023 cash bushels have likely been sold, traders could’ve gone long the market near the March settlement of $5.3819 based on the latest bullish spike reversal. If so, sell stops would be placed below the March low of $5.0960.

The SRW Wheat Price Index (IWY00) remained a difficult read as July turned to August. The key is the July low of $4.6521 held above the previous mark of $4.6065 from September 2023. Theoretical Positions: I don’t see where traders would have a position at this time.

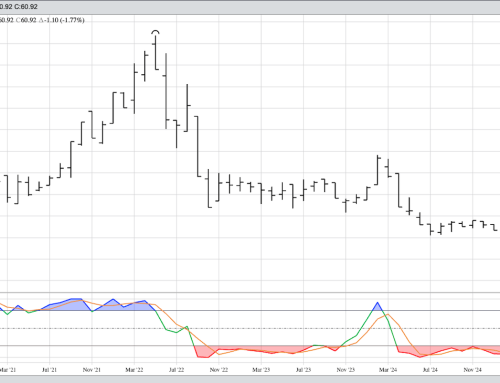

The HRS Wheat Price Index (IPY00) extended its major downtrend to a low of $5.2646 during July before closing at $5.3176, down 32.87 cents for the month. However, finishing July near the monthly low sets the stage for a potential bullish reversal during August. Theoretical Positions: There are no positions at this time. If there is some early harvest during August, bushels could be held on the idea the index could complete a bullish reversal during the month.

The Teucrium Wheat Fund (WEAT) moved back into a major downtrend as it took out its previous low of $5.02 (March 2024) during July. Theoretical Positions: Sell stops would’ve been triggered as WEAT took out its previous low during July.