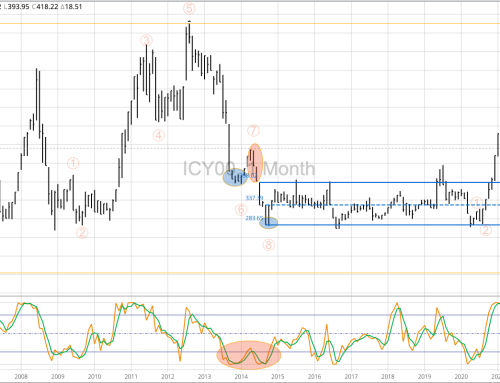

The continuous monthly chart (nearby futures contract) for lean hogs shows the market to be still be flying high in a major (long-term) uptrend. The nearby May futures contract closed at $110.125 after posting a monthly high of $111.775. Fundamentally the market remains bullish at least through the end of the year, as indicted by the June-August, August-October, and October-December futures spreads. Technically, nearby futures broke out of the previous sideways trend between roughly $93.00 and $49.00, a range of approximately $44, setting a technical upside target near $137.00 (high end of the range plus the range). The all-time high for nearby futures is $133.80 from July 2014.

The most popular position is to still be long, based on long-0term market fundamentals, with the previous 4-month low all the way down at $66.125. Risk/Reward does not favor adding new longs at this point. Monthly stochastics are approaching 100% indicating a sharply overbought situation.