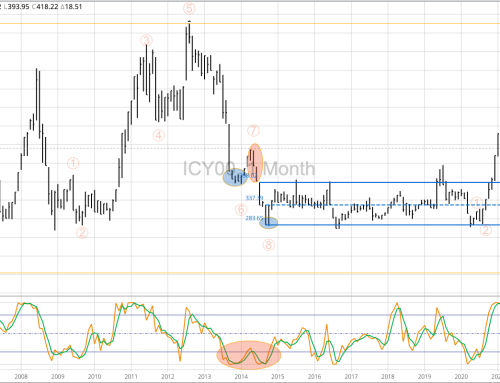

On one hand, the continued weakness of the Brazilian real at the end of September could have North American soybean producers concerned. on the other hand, the real hasn’t gone anywhere since breaking down with everything else during March 2020, and the global soybean market has continued to turn. The end of September saw the real close at 0.18367, a new 4-month low monthly close, with the September low of 0.18259 the new 4-month low. Given the real remains in a sideways range between the May 2020 low of 0.16756 and April 2020 high of 0.20739, it should come as no surprise September’s close was near the midpoint of 0.18748. Frankly, the real could move either direction during October and it would still look cheap. However, if it ever breaks out of its sideways range it would be expected to make a quick 0.03983-point move, putting the downside target at 0.12773 and the upside mark at 0.24772. Of the two, an upside breakout still seems the most likely at some point.